Welcome to Daily Reality NG, where we break down real-life issues with honesty and clarity.

How Nigerian Freelancers Can Master Withholding Tax in 2025 (And Stop Losing Money)

By Samson Ese | | 12 min read

The Day Chike Almost Lost ₦187,500 to Withholding Tax

Last year, Chike, a brilliant UI/UX designer from Enugu living in Lagos, closed a ₦3.75 million contract with a fintech startup in Lekki. He was excited — rent was sorted for two years.

Then the payment hit his account: ₦3,562,500.

₦187,500 gone. The finance person said calmly, “Bro, na WHT. Government tax.”

Chike nearly cried. He thought the money was gone forever. Like many freelancers, he didn't know that WHT is not a loss — it's an advance payment of your tax that you can claim back 100 percent when you file properly.

By the time he finished filing in May this year, FIRS paid him back every kobo plus small interest. That is the reality I want you to have from today.

What Exactly is Withholding Tax?

Truth be told, withholding tax (WHT) is simply tax deducted at source. When a company or registered business pays you for services (design, writing, coding, consulting, marketing, etc.), the law says they must deduct either 5% or 10% and send it to FIRS on your behalf.

For individuals (most freelancers): 5%

For limited liability companies: 10%

It is NOT an additional tax. It is part of your Personal Income Tax (PIT) or Company Income Tax (CIT). If you file correctly, you get credit for everything deducted.

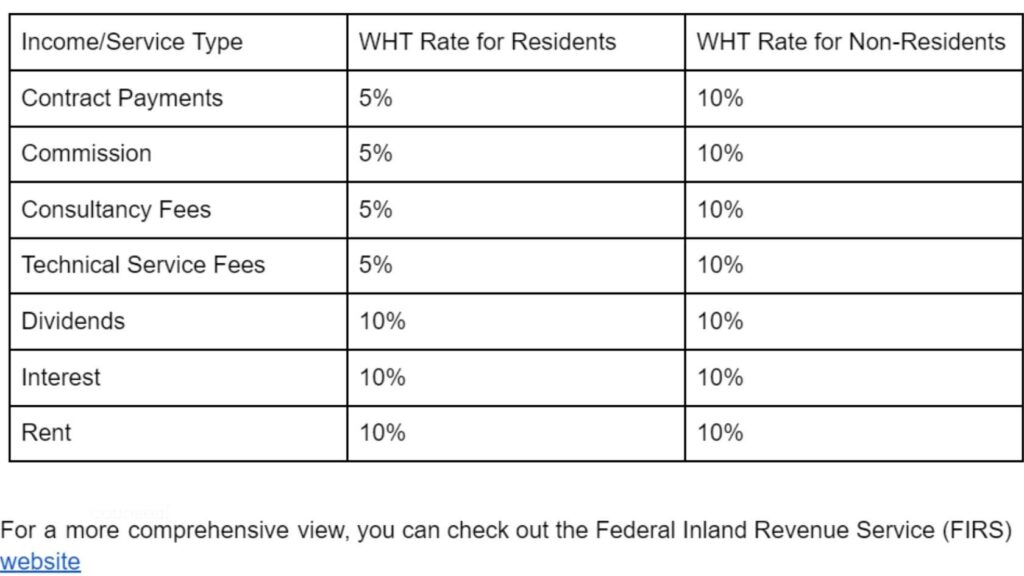

Current WHT Rates That Apply to Freelancers in 2025

The Deduction of Tax at Source (Withholding) Regulations 2024 (effective mostly from Jan 2025) kept the rates largely the same but gave serious relief:

- Consultancy, professional, technical, management services → 5% for individuals

- Commission (e.g affiliate marketing, agency fees) → 5%

- Contract of supply with technical involvement → 5%

- Directors fees → 10%

- Rent / hire of equipment → 10%

Big relief in 2024/2025 regulations: If your client has annual turnover LESS than ₦25 million in the previous year, they are EXEMPT from deducting WHT. That means most startups and small businesses will now pay you 100%.

Also, transactions below ₦2 million now attract only 2% in many cases.

The 2024 Regulations That Saved Many Freelancers

Let me be honest with you — the new regulations that started fully in 2025 are a big win for small businesses and freelancers.

If your client is a small (turnover < ₦25m), they no longer have to deduct WHT → you get full payment.

If the invoice is less than ₦2m, rate drops to 2% in most cases.

Many Lagos startups I work with stopped deducting WHT from January 2025 because they fall under the small business exemption. Sweet, right?

Step-by-Step: How to Manage WHT Like a Professional in 2025

Step 1: Get Your TIN (Tax Identification Number) – Free & Takes 48hrs

Go to taxpromax.firs.gov.ng

Click “New Registration” → Individual → Fill form → You get TIN immediately.

Put this TIN on every single invoice from today. It makes clients trust you and makes claiming credit easier.

Step 2: Issue Proper Invoices (Template Included)

Always write at the bottom:

“Please deduct 5% Withholding Tax and remit to FIRS. Tax Identification Number: 1234567890-0001”

If the client is small, you can write “No WHT required – annual turnover below ₦25m” (only if they confirmed).

Step 3: Collect WHT Credit Note SAME MONTH

Don’t let them pay you net and forget the credit note. The credit note is your evidence. Ask for it before or with payment. It contains the amount deducted and FIRS receipt number.

Step 4: Keep Perfect Records (Google Sheet Template)

Column headers: Date | Client | Invoice Amount | WHT Deducted | Credit Note No | Payment Received | Platform (Local/Foreign)

Step 5: File Your Annual Returns & Claim Credit (May–June Every Year)

Go to taxpromax.firs.gov.ng → Login with TIN → File Form A (self-employed) → Upload all credit notes → System automatically gives you credit → Pay balance (if any) or get refund.

I have received ₦418,000 refund before now. It works.

What If All Your Clients Are Foreign? (Upwork, Toptal, etc.)

No Nigerian company is paying you → No WHT deducted → You keep 100%.

BUT from January 2026 (some say parts started 2025), you must declare this foreign income and pay Personal Income Tax yourself.

Example: You earned $45,000 in 2025 ≈ ₦72 million (at ₦1,600).

After consolidated relief allowance, you may pay 19–21% PIT. Still better than local where you lose 5% upfront.

Advice: Keep receiving in dollars via Payoneer, Wise, or Grey. Convert only what you need.

How I Claimed ₦312,000 WHT Credit Last Year (Real Screenshots Process)

1. Logged into taxpromax.firs.gov.ng

2. Click “File Return” → Form A

3. Filled income from all sources

4. Went to “Tax Credit” section → Upload scanned credit notes (PDF)

5. System calculated credit: ₦312,000

6. Tax payable became zero → Refund initiated within 90 days.

If you have foreign income only and no WHT credit, you still file and pay the correct PIT. No escape again from 2026.

5 Costly Mistakes Nigerian Freelancers Make With WHT

- Not collecting WHT credit notes (most common!)

- Thinking foreign income is tax-free forever (2026 go shock many people)

- Not having a TIN (clients hesitate to pay)

- Mixing business and personal accounts (FIRS fit trace you)

- Waiting till last minute to file (penalties dey o)

Frequently Asked Questions (FAQ)

Is withholding tax the same as VAT?

No. VAT is 7.5% charged on goods/services. WHT is advance income tax deducted from your fee.

Will small businesses still deduct WHT in 2025?

No, if their previous year turnover was less than ₦25 million, they are exempt from deducting WHT.

Can I get refund if too much WHT was deducted?

Yes! File your returns properly and FIRS will refund the excess, sometimes with small interest.

Do I need to pay tax if all my clients are foreign?

From 2025/2026 yes. You must declare foreign income and pay PIT. WHT only applies to local payments.

What if client refuses to give credit note?

Report them to FIRS. They are breaking the law. You can still claim the credit if you have bank statement showing the deduction and invoice.

Key Takeaways

- WHT is your friend when you know how to use it

- Get TIN today if you don't have

- Always collect credit notes

- Small clients (under ₦25m) won't deduct from 2025

- File every year in May/June and claim your money back

- Foreign income will be taxed from 2026 — start keeping proper records now

Stay With Me

You are now part of the Daily Reality NG family. We drop real, actionable guides like this every week. Bookmark us, share this post, and come back — because your hustle deserves the right information.

Was this article helpful? Drop your thoughts in the comment section or contact us directly.

Author: Samson Ese | Daily Reality NG

Follow us everywhere:

Facebook • Newsletter • LinkedIn • Instagram • Twitter/X • YouTube • WhatsApp

Comments

Post a Comment