Reading time: 12 minutes

Decoding CBN's Tight Grip: Navigating Monetary Policy in Everyday Nigeria

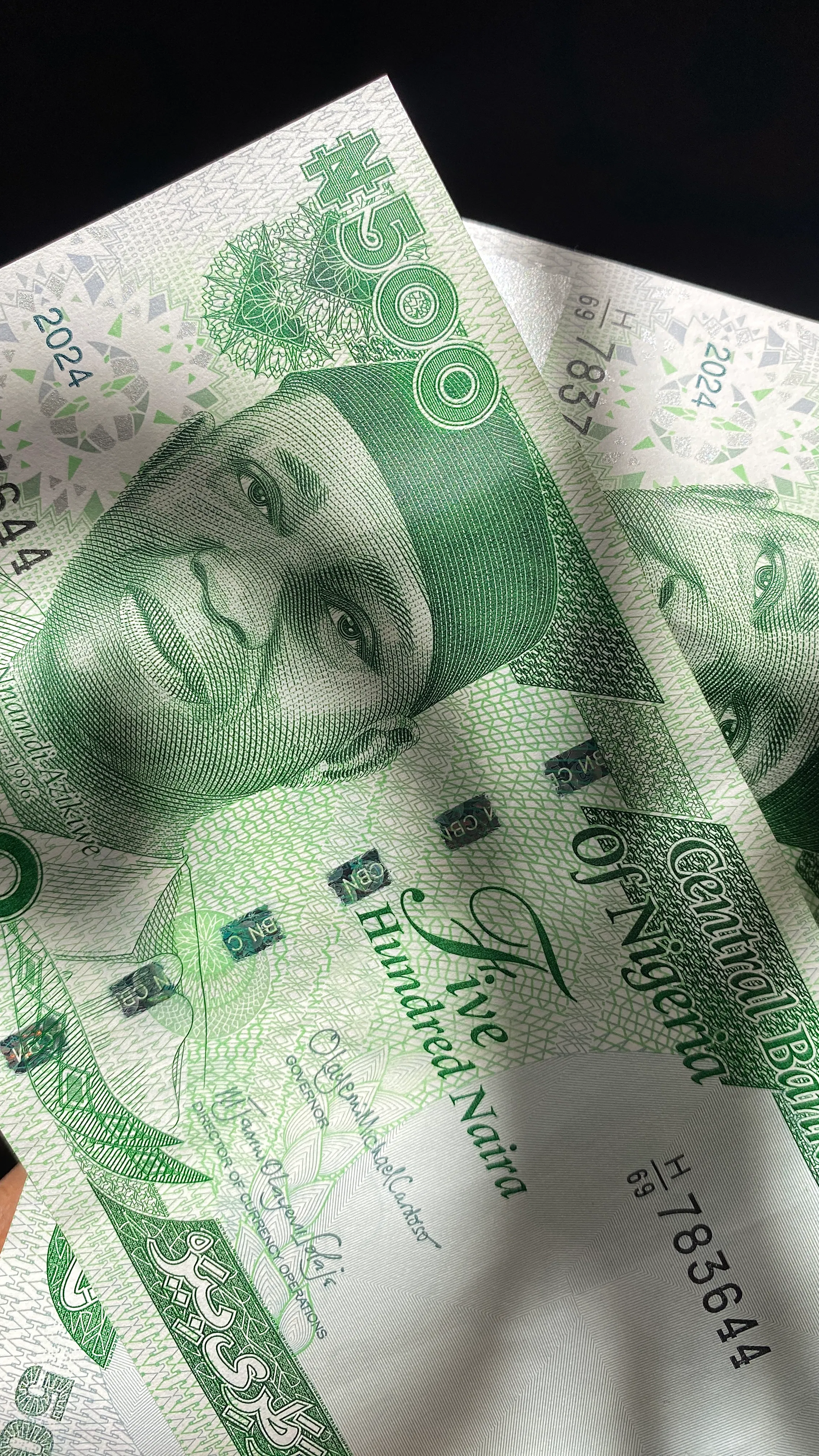

Have you ever stared at your bank statement, wondering why that loan repayment feels like it's eating into your hard-earned savings more than before? You're not alone—it's the quiet ripple of the Central Bank of Nigeria's (CBN) monetary tightening policy at work, shaping our wallets in ways we can't ignore.

Welcome, my friend, to another heartfelt corner of Daily Reality NG, where we peel back the layers of life's big questions over a cup of steaming tea—or perhaps a cold zobo on a hot Lagos afternoon. I'm Samson, your guide through the maze of Nigerian realities, and today, we're sitting down to unpack something that's been buzzing in markets, boardrooms, and family dinner tables alike: the CBN's monetary tightening. Pull up a chair; let's make sense of it together, calmly and clearly, because understanding this isn't just smart—it's your edge in building a steadier tomorrow.

A Moment from My Week That Hit Home

Last Saturday, as I wandered through the bustling aisles of Balogun Market in Lagos, the air thick with the scent of spices and the chatter of hagglers, I couldn't help but pause at Mama Chinedu's stall. She's been selling fabrics for over two decades, her smile as warm as the harmattan sun. But this time, her eyes carried a quiet worry. "Samson, my boy," she said, folding a vibrant ankara print, "the prices keep climbing, and my customers are tightening their belts. Even with the CBN's big talk on stability, it's hard to see the light at the end." That conversation lingered with me, a raw reminder that policies penned in Abuja echo loudly in our daily grind. It's moments like these that pull me back to why I started Daily Reality NG—to bridge the gap between lofty economic decisions and the real lives they touch.

The Trader's Tale: A Lesson from the Heart of Naija Hustle

Let me take you back to a dusty afternoon in Kano, where the sun hangs low like a watchful elder. There was this young trader named Aisha, fresh from her apprenticeship, who poured her life's savings into a small provision store on the edge of the ancient city walls. With dreams as big as the River Niger, she stocked shelves with tins of Milo, bags of garri, and bolts of indigo-dyed cloth that whispered stories of old trade routes. Business hummed at first—customers trickled in, laughter filled the air, and Aisha's ledger balanced like a well-tuned kora.

But then came the whispers of change from the CBN towers in Abuja. Interest rates climbed like vines on a harmattan fence, squeezing the life out of loans that once flowed freely. Aisha's supplier, an old family friend, hiked prices to cover his own borrowing costs, and her bank loan's repayments ballooned overnight. One evening, as the call to prayer echoed, she sat amid unsold goods, tears mixing with the sweat on her brow. "How do I keep the fire alive when the winds of policy blow so fierce?" she wondered. Yet, in true Nigerian spirit, Aisha didn't fold. She bartered smarter, joined a local cooperative for bulk buys, and turned her store into a community hub for shared savings schemes. Months later, her shelves brimmed again, a testament that even in tightening times, resilience blooms like the resilient baobab.

Aisha's story isn't just yarn-spun for the telling—it's the heartbeat of so many hustles across our land. It reminds us that monetary tightening, for all its stern face, is a tool wielded to protect the very soil we till. And in understanding it, we find our own seeds of adaptation.

What Exactly is Monetary Tightening? Breaking It Down Simply

At its core, monetary tightening is the CBN's way of pulling back on the money faucet to cool an overheated economy. Think of it like your mother rationing the family pot of soup during lean times—not out of meanness, but to ensure it lasts. The bank achieves this through levers like hiking the Monetary Policy Rate (MPR), which is the benchmark interest rate banks charge each other. When the MPR rises, borrowing gets pricier across the board, slowing spending and investment that might fuel inflation.

The Key Tools in the CBN's Kit

Here's where it gets practical. The CBN doesn't just wave a wand; they tweak specifics:

- Monetary Policy Rate (MPR): This is the big one. At 27.50% through much of 2025, it's making loans sting but savings accounts smile a bit brighter.

- Cash Reserve Ratio (CRR): Banks must park more of their deposits—up to 50% for commercial banks—leaving less to lend out freely.

- Liquidity Ratio: Ensuring banks hold enough liquid assets, curbing risky lending sprees.

These aren't abstract numbers; they're the threads weaving through your next car loan or business expansion. For a deeper dive into interest rates' role in personal finance, check our guide on saving smarter in volatile times.

Why is the CBN Tightening the Reins Now?

Inflation has been our uninvited guest for too long, hovering above 20% and eroding the naira's purchasing power like termites in a wooden beam. Food prices soar, fuel costs bite, and global shocks—from supply chain snarls to geopolitical jitters—pour fuel on the fire. The CBN's tightening is a deliberate squeeze to tame this beast, aiming to anchor expectations and stabilize the currency.

Inflation's Nigerian Flavor

In Nigeria, it's not just numbers; it's the yam seller watching her margins vanish or the tech startup delaying hires. By August 2025, headline inflation dipped to 20.12% from 21.88% the prior month, a small win credited to tighter policy and better harvests. But challenges persist: naira volatility and import dependencies keep the pressure on.

For context on inflation's broader strokes, our in-depth look at beating inflation offers more tools tailored for Naija living.

The Global Echo

We're not alone—central banks worldwide, from the Fed to the ECB, have danced this tango. Yet, in our context, it's about safeguarding forex reserves and fostering local production. A nod to the CBN's site for the full communique: CBN MPC September 2025.

The Ripple Effects: How Tightening Touches Your Life

Like stones skipped across the Lagos Lagoon, these policies send waves far and wide. For consumers, borrowing a car or home loan now demands deeper pockets, but fixed deposits yield better returns— a silver lining for savers. Businesses feel the pinch hardest: higher costs crimp expansions, yet it weeds out speculative bubbles, paving way for sustainable growth.

On the Family Table

Picture this: Your child's school fees loom, but with rates up, that education loan's interest compounds quicker. On the flip, it's a nudge toward budgeting tighter, perhaps channeling funds into inflation-beating assets like treasury bills.

Business Owners' Balancing Act

Small enterprises, the engine of our economy, navigate higher operational costs. Yet, many adapt by digitizing payments or tapping microfinance with creative twists. Liquidity dipped to N0.16 trillion in Q2 2025, per CBN reports, signaling caution—but also opportunity for the prepared.

CBN's 2025 Moves: From Hold to a Gentle Ease

Through July 2025, the CBN held firm at 27.50% MPR and 50% CRR, a steadfast guard against inflation's surge. But by September, sensing moderation, they trimmed the MPR to 27% and eased CRR slightly— the first cut since hikes began, signaling confidence in the naira's resilience. Reserves bolstered by FX reforms have helped, drawing inflows and curbing interventions.

Looking ahead, experts eye potential further tweaks late 2025 if stability holds. This isn't easing up entirely; it's calibrated tightening, balancing growth with price control.

Clear, Actionable Advice: What You Can Do Today

Knowledge without action is like a lantern in the day—pretty, but pointless. Here's your toolkit, simple and straight from the trenches:

- Review Your Debts: Prioritize high-interest loans; refinance if possible or consolidate to lower rates. Aim to pay down 20% extra monthly where you can.

- Boost Savings Yields: Shift to high-yield accounts or FGN bonds—rates now flirt with 20%, outpacing inflation's bite.

- Budget Like a Pro: Track expenses with apps like Cowrywise; allocate 50% to needs, 30% wants, 20% savings/debt.

- Diversify Income: Side hustles in digital services or agriculture can buffer shocks—start small, scale smart.

- Stay Informed: Follow CBN announcements; join communities like our Daily Reality NG newsletter for timely alerts.

Implement one today, and watch the momentum build. For more on building financial resilience, dive into our resilience blueprint.

Empowerment in the Squeeze: Why This is Your Moment to Rise

In the quiet strength of tightening times lies a profound invitation: to rethink, refine, and reclaim control over your financial narrative. You've weathered fuel hikes, naira dips, and more— this policy isn't a wall, but a forge, tempering your hustle into something unbreakable. Imagine Aisha's store, not diminished but diversified; your own path, not derailed but directed with wiser choices. Step forward with that unyielding Naija spirit—educate yourself, act decisively, and build legacies that outlast any rate hike. You're not just surviving; you're scripting success on your terms. Let's turn this policy pivot into your personal prosperity play.

Key Takeaways

- Monetary tightening raises rates to fight inflation, stabilizing the naira but raising borrowing costs.

- CBN held at 27.50% MPR until September 2025's slight ease to 27%, amid moderating inflation at 20.12%.

- Impacts include pricier loans for consumers and tighter credit for businesses, but better savings returns.

- Action steps: Review debts, boost savings, budget rigorously, and diversify income streams.

- Resilience turns challenges into growth—adapt, and you'll emerge stronger.

Was this article helpful? Share your thoughts below or contact us.

Frequently Asked Questions (FAQ)

What is the current Monetary Policy Rate (MPR) in Nigeria?

As of September 2025, the MPR is 27% after a 50 basis point cut from the previous 27.50%.

How does monetary tightening help control inflation?

It reduces excess money in circulation, cools down spending, and brings demand-pull inflation under control. Headline inflation dropped from 21.88% to 20.12% recently.

Will loan interest rates come down soon?

Possibly before the end of 2025 if inflation continues trending downward, but the CBN will only ease when price stability is locked in.

Is this a good time to save money in the bank?

Yes! With rates this high, fixed deposits and treasury bills are now offering 20%+ returns—one of the few silver linings of monetary tightening.

Comments

Post a Comment